Buyer

Buyer

The Ultimate Guide to Home Financing

Debunking the Myths and Securing Your Future

Entering into 2026, the housing market has reached a new stage of maturity. While the frenzy of previous years has cooled, a different kind of challenge has emerged: misinformation. Even for those who have owned homes before, the mortgage landscape has shifted significantly, and old “rules of thumb” no longer apply.

If you are looking to purchase a home this year, your greatest asset isn’t just your down payment—it is your information. By clearing up common misconceptions early, you can move forward with the confidence to seize opportunities that others might miss.

Here is the truth behind the most common mortgage myths as we navigate the path to homeownership today.

Myth 1: You Need a 20 Percent Down Payment

The “20% down” rule is perhaps the most persistent myth in real estate. While putting 20% down is a great way to eliminate Private Mortgage Insurance (PMI) and lower your monthly payment, it is by no means a requirement.

The Reality for 2026 Buyers:

Today’s loan programs are designed to help you get into a home sooner without draining your entire life savings.

- FHA Loans: Allow for a down payment as low as 3.5%.

- Conventional Loans: Many options exist for as little as 3% down.

- VA and USDA Loans: If you are a veteran or buying in a qualifying rural area, you may be eligible for 0% down.

- Down Payment Assistance (DPA): Many lenders offer specialized programs or work with state agencies to provide grants or secondary loans that cover the down payment entirely, making 100% financing a reality for qualified buyers.

In Wisconsin, the Wisconsin Housing and Economic Development Authority (WHEDA) provides specialized loan programs and down payment assistance that can cover up to 6% of your purchase price, effectively allowing for 100% financing for qualified buyers. These programs offer flexible credit guidelines and reduced mortgage insurance costs, making homeownership in Wisconsin significantly more affordable than traditional financing.

Myth 2: You Need Perfect Credit to Qualify

Many potential buyers stay in the rental cycle because they believe their credit score isn’t “perfect” enough for a mortgage. While a higher score can help you secure a lower interest rate, a “fair” score is not a dealbreaker.

The Reality of Credit Flexibility:

Lenders have become increasingly sophisticated in how they view creditworthiness.

- FHA programs are specifically designed for those with less-than-perfect credit.

- Credit Counseling: Most reputable lenders offer resources to help you understand how your score impacts your rate and can guide you on how to improve your profile.

- The Early Check: It is always better to know your standing early. Getting a clear picture of your credit profile months before you want to buy gives you time to make small adjustments that could save you thousands over the life of the loan.

Myth 3: Pre-Approval is a Guaranteed Loan

It is a common mistake to think that once you have a pre-approval letter in hand, the financing is a “done deal.” In reality, a pre-approval is an estimate of what you can borrow based on an initial review of your finances.

The Path to Full Approval:

Final loan approval depends on a process called underwriting, which happens after you find a home.

- Keep it Consistent: Once you are pre-approved, avoid making large purchases (like a new car), changing jobs, or moving large sums of money between accounts.

- Verified Pre-Approvals: Look for lenders who offer “fully underwritten” pre-approvals. This means a human underwriter has already reviewed your files, giving you a massive advantage when you find “the one.”

Myth 4: All Mortgages Are Basically the Same

Choosing a mortgage is not like buying a gallon of milk; it is a strategic financial decision. The “structure” of your loan—how long it lasts and how the interest is calculated—can change your financial life for years to come.

Your Options Include:

- Fixed-Rate Mortgages: Your payment stays the same for 15 or 30 years.

- Adjustable-Rate Mortgages (ARMs): Often offer a lower initial rate for a set period, which can be a smart move if you plan to move or refinance in a few years.

- Specialized Products: For investors, DSCR (Debt Service Coverage Ratio) loans allow you to qualify based on the property’s potential rental income rather than your personal salary.

- Lender-Specific Incentives: Many modern lenders now offer programs that reduce or eliminate traditional fees like origination or processing to stay competitive.

Myth 5: Always Chase the Lowest Interest Rate

It is tempting to shop around for the single lowest percentage point you can find. However, the “lowest rate” advertised online often comes with hidden costs.

What to Look For Instead:

- Closing Costs and Points: Some lenders offer a low rate but charge high “points” (upfront fees) to get it. You might pay $5,000 today just to save $20 a month—it could take you decades to break even.

- The Total Cost: Look at the APR (Annual Percentage Rate), which reflects the true cost of the loan including fees.

- Flexibility: Does the loan allow for a future refinance without heavy penalties? A trusted loan officer will provide a side-by-side comparison so you can see the long-term trade-offs.

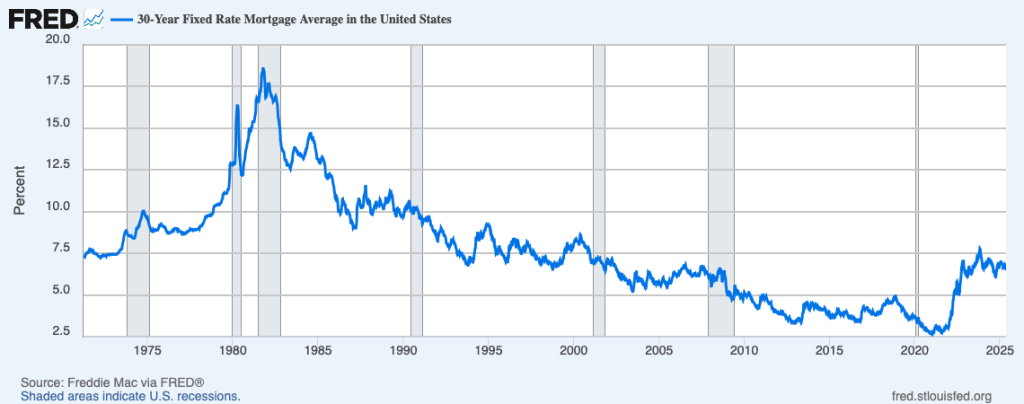

Myth 6: It Is Better to Wait Until Rates Drop

Many people are sitting on the sidelines entering into 2026, waiting for a dramatic drop in interest rates. While it is natural to want the lowest rate possible, “waiting for the bottom” can be an expensive mistake.

The Strategy of “Date the Rate, Marry the House”:

- Equity Growth: While you wait for a 1% drop in rates, home prices may continue to rise. You might save on interest but end up paying significantly more for the house itself.

- Refinance Later: If you buy now, you begin building equity immediately. If rates drop later, you can refinance into a lower rate. If rates go up, you’ll be glad you locked in today’s price.

Ready to see what’s possible for you?

The biggest obstacle to buying a home isn’t usually the bank—it’s the myths that stop you from starting the conversation. When you have the facts, you make stronger decisions.

There are more pathways to homeownership today than most people realize, from zero-down programs to credit-flexible financing. The key is to stop guessing and start planning.

Don’t let mortgage myths hold you back from your goals. Whether you are a first-time buyer or a seasoned investor, we are here to help you navigate the numbers.

Contact us today to talk through your specific situation. We can sit down for a detailed consultation or introduce you to one of the highly recommended loan officers we partner with. They specialize in finding the right fit for your unique financial profile, ensuring your path to homeownership is as smooth as possible.